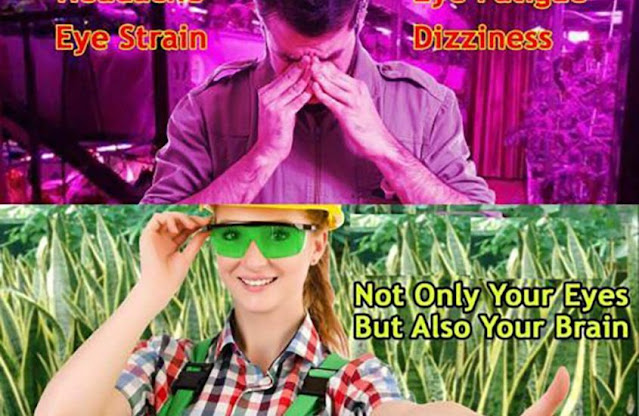

Best Led Grow Room Glasses 2021

Nelophobia, the fear of broken glass, may have led to a thought that developed into a replacement business that went from zero to $60 million in only 3 years. We had a robust core business and an honest idea. In 3 years we had a $60m business expansion without making a purchase , without building a factory, with nearly zero capital investment, and a staff addition of... 3.

This series, Double-Digit Growth during a Slow Economy, discusses the methods that have successfully been wont to drive growth once you aren't ready to calculate a growing economy. We reference actual cases and corporations that were transformed into growth engines beyond the natural buoyancy of economic process . This installment discusses growth driven by entering new categories of products as an extension of the general growth strategy.

Growth through near adjacencies

Once you've got strengthened your core business and may leverage those strengths, you'll likely find the market is hospitable your expansion through near adjacencies. These are opportunities that directly leverage some or all of the weather of your core business. Leaping too faraway from the core business works for a few , but it's tougher , takes more resources, and most significantly it fails to leverage the strengths of the core business. Leveraging those strengths and resources may be a smaller amount of a distraction when the initiative is a near adjacency. Starting a.com business could also be strategically important, but might not be a near adjacency. If it's strategically critical, you would like to think about it a begin with its own independent resources. this might also help prevent building in an excessive amount of of your current business model into what should be a very new business. it's irresistible to use your current resources, but the differences within the business cause distraction within your team and dilution of resources. For expansion that doesn't meet the definition of a near adjacency, establishing a begin is that the preferred thanks to go. Once it's off the bottom and has it's own operational stability, you'll consider strategic options to expand, integrate, spin off, etc. For this discussion it's important to define a near adjacency.

A near adjacency is an expansion opportunity that leverages a broad cross section of your core competencies. The more which will be leveraged, the better to execute and build financial performance from your expansion initiatives. A near adjacency is usually more financially accretive nah evident when watching product margins alone. Because this expansion leverages such a lot of the present business's strengths, the autumn through to the EBITDA line is critical . If an expansion requires significant capital and staffing to manage it's going to not have the returns of an expansion which will fit within the envelope of the present business. people who fit more neatly within the current structure are often lower risk for an equivalent reason. Defining a near adjacency starts with defining the core competencies you'll leverage. they need to be relevant competencies to your customers so as to make a worth proposition for expansion.

Some potential competencies that are often leverage-able:

Key channel strengths and relationships

Sourcing and provide chain

Design

Engineering

IP or patents

Logistics and repair efficiency

Relevant brands with equity in broad categories

Capacity - Physical space, processes, and other people

A start line is identifying strong channel relationships which will be leveraged or a robust product position which will be extended into a replacement geography. it's also helpful to possess an objective scoring method to think about the advantages , investment, and risks related to a category expansion.

Customer need is a crucial entry point

Expansion through near adjacencies could also be opportunistic. it's important to concentrate closely to the customer's issues. in additional than one case, I even have been asked to enter a replacement category of products by the customer. that they had a priority over their supply chain and saw our company as a robust supplier that would extend into something new. These opportunistic expansion opportunities are the foremost interesting since there's already a chance for interrupting the present supply arrangements. it's far easier to get an audience for your proposal when there's a requirement on the a part of the customer. When it's not opportunistic, it's critical to make a worth proposition that resonates with the customer or better yet, with the top user also . the only is a plus within the customer's acquisition cost. Old-fashioned lower cost is usually too good to pass up. does one have a price advantage? If you are doing , it's going to work, but if you are doing not, it's likely all you'll accomplish is reducing your competitor's margin. they will answer your offer of lower cost . If that's the extent of your value proposition it's likely getting to fail to secure new business for you or worse, find yourself providing a replacement business that has poor margins.

See Also : https://householdneed.com/best-led-grow-room-glasses/

The expansion by near adjacency should cause a stronger value proposition for the customer. It might be a gaggle of advantages that individually needn't be significant, but in total they're meaningful. Assuming you're selling to a channel partner sort of a distributor, dealer, or retailer the worth proposition are often centered on driving their margins. If you're selling on to a consumer or user , the worth proposition must offer a plus to the user. In most cases we are more happy not targeting acquisition cost as a way of entry unless we've a sustainable cost advantage within the goods.

Layering on improvements within the products that cause better sales for your channel partners is a crucial opportunity to develop. Merchandising, packaging, simpler to put in or service, a replacement design or features cause a compelling case for the customer to modify . Hitting a mess of advantages creates the foremost compelling position. A product that sells better than its predecessor may be a great start. The customer has got to believe they're going to have better business results taking over your new extension. If the incumbent has problems the bar is lower, but a package of clearly articulated benefits demonstrating how the customer's business results are improved is that the start line . "New" isn't enough. "New and improved", you're getting warmer.

Zero to sixty... Million

The company that had turned from a downslide to rapid climb with a 19% annual rate of growth driven by gains in share, not an economic gift. We had achieved 100% of our largest customer's shelf in our core category, 60% with our second largest, and 100% with our third. We were running out of growth runway. We had built a much more efficient organization that was designed for growth and performing so well, we were close to run out of share to realize .The Sales team was tasked to cultivate new accounts for our core products and expansion with smaller customers where we had growth opportunities. We quantified our available targets for growth with new and existing customers and it had been quickly apparent we would have liked a replacement category of products to supply . We began a project to seem at categories we could expand therein would leverage our strong customer relationships, our supply chain, and facilities. I established a director of latest category development to specialise in developing new product categories to facilitate continued growth at a rate much greater than the expansion of the economy. (Shout bent Pat Boehnen)

We needed a replacement category that we could leverage with our strongest "core" customers. They knew us best and that we had credibility and competency in serving them. Our new category team created a solid list of opportunities and performed research around current suppliers, level of innovation, estimates of market size and used our rating system to project which categories would offer the simplest opportunity. Nothing was a slam-dunk, but we initiated work on the highest three areas to ascertain if we could develop a replacement business. this is often inherently future compared to increasing sales of current products which are able to ship, versus a group of products that might take a minimum of a year to develop if not longer. This emphasizes the purpose of getting simultaneous effort to manage the corporate performance curve. We were growing at 19% and didn't want to ascertain growth slow to five . within the near term our sales team could fill the gap by selling our current goods more successfully to a broader customer list. We established more sales presence in our nearest international opportunity, Canada. it had been the foremost serviceable area of geographical growth considering our presence. This continued our growth during the category development period until our new categories could start in touch fruit.

We needed a replacement category that offered a compelling advantage over the present suppliers, who by the way were likely years ahead in their own core category we sought to enter and beat them in. Yes, it's a large order once you put it in those terms. you would like an entry point. A stale category perhaps. A sleepy competitor. An innovation or technology you'll bring back a category first. a price advantage you'll use to make a worth for the customer. Better services that support your products. These are a number of the sorts of advantage you'll bring over a competitor. As a start-up, you've got to bring more benefit than simply a tweak or two. If you can't bring a big advantage of your own, you would like a call for participation from the customer. they have to require a supplier change and see you as a corporation that has certain strengths. Perhaps the incumbent is battling fill rates, quality, or the foremost likely reason to stimulate change... they need initiated a increase .

Our new category team was doing a pleasant job identifying opportunities and commenced to style products and programs to check with our supply chain also like key customers. In each of the three highest ranked opportunities there have been challenges. The category you would like to enter needn't be fast growing. Often times companies feel they have to chase the fast growing segment or geography so as to grow. it's nice in fact , but you overlook current mature revenue that's there for the taking in larger categories. to not mention that fast growing categories invite more new entrants. because the new entrant, we seek to grow far more by share gain, not through normal category rate of growth . we might rather not duke it out as we get our bearings within the category with others entering at an equivalent time.

US based companies with reasonably strong share positions often are lured into thinking international growth is vital once they check out markets growing at faster rates than the US. We all chased BRIC countries a couple of years ago and located significant barriers. we glance at growth rates and think that's where the expansion is. US companies add the most important economy on the earth . i feel international growth is a crucial strategy, but if you've got strength within the US, you'll grow even when the market growth is at a slow rate. there's tons more share to realize where you've got assets and a solid understanding of the market than a foreign start-up. This emphasizes the chance offered by category expansion over other forms if you'll leverage your presence. While our category development team was modest with a staff of three people, they were making good progress on the conceptual aspects of the initiative.gory by improving the buyer experience.

Comments

Post a Comment